Demystifying SW Houston’s Government: How TIRZ 20 Collects Local Property Taxes

If you’re like me, you probably read the eight-foot-wide sign at Club Creek Park and think, “Okay, so what?” It says that something called TIRZ #20 contributed $1.3 million to the new Houston Vietnam Veterans Memorial. At this point, your eyes are probably glazing over—or you’re wondering what a TIRZ even is.

Actually, that’s a great question.

It’s even more important than you might think. TIRZ #20 also spent $13 million on building Club Creek Park itself, which doubles as a flood control basin—an overflow pond to keep Brays Bayou from flooding during storms.

That means TIRZ #20 spent around $14.3 million on projects in Club Creek Park. That money just might come from your property taxes.

TIRZ stands for Tax Increment Reinvestment Zone. Eyes glazing over again? Don’t worry. Here’s what that means in plain English: a certain amount of property tax money (the “increment”) from a specific area gets used to improve that same area (“reinvested”). If not for the TIRZ, the money would be sent to the city-wide pool of tax money, where it could be spent on projects anywhere in Houston. But a TIRZ spends tax dollars in the area that made them.

When a neighborhood isn’t developing quickly enough, the City Council can turn it into a TIRZ. (Actually, the City of Houston’s website says it this way: to become a TIRZ, an area must “Substantially arrest or impair the sound growth of the municipality or county creating the zone, retard the provision of housing accommodations, or constitute an economic or social liability and be a menace to the public health, safety, morals, or welfare in its present condition and use.” Ouch.)

When an area becomes a TIRZ, the City of Houston marks the property values within the zone. If the property values rise above that mark due to local improvements, the extra property taxes (the “increment”) go to the TIRZ, not to the City of Houston’s general-purpose fund.

Here’s an example (brace yourself for some math). Let’s say the original total property value in a TIRZ area is $100 million. At the 2022 city tax rate—just over half of one percent—that would create approximately $533,000 in property taxes. But the next year, the total property value rises to $110 million, which would create just over $587,000 in city property taxes. (You also pay property taxes to HISD and Harris County, but those aren’t part of the TIRZ equation.)

Assuming city tax rates stayed the same, property taxes just rose by an increment of $54,000. So $533,000 goes to the City of Houston, and $54,000 goes to the TIRZ, which spends it on the neighborhood that produced the money in the first place.

That was just an example, but the actual numbers are much higher: TIRZ #20 (created in 1999) will receive an estimated increment of $11.2 million from 2022’s taxes, according to its latest budget.

(Okay, we’re done with the math.)

Does this mean you’re paying more taxes? Nope. TIRZ #20 just takes a portion of the taxes that property owners would have paid to the City of Houston anyway. It invests that money back into the community, into projects like reconstructing Bellaire Blvd. in 2014, replacing damaged portions of other Sharpstown streets in 2021, and building Club Creek Park, which is designed to hold the amount of water that would cover at least 120 acres one foot deep. That water could otherwise end up flooding the Brays Bayou area, which includes parts of Sharpstown, Westwood, Alief, and Braeburn.

So are some of your property taxes going to TIRZ #20? If you own a business in the Sharpstown area, probably. That includes many apartment complexes. If you live in an apartment, then your landlord’s property taxes may fund TIRZ #20 (which would mean that, indirectly, your rent does too). But if you live in a house in Sharpstown, your property taxes or rent will probably not fund the TIRZ.

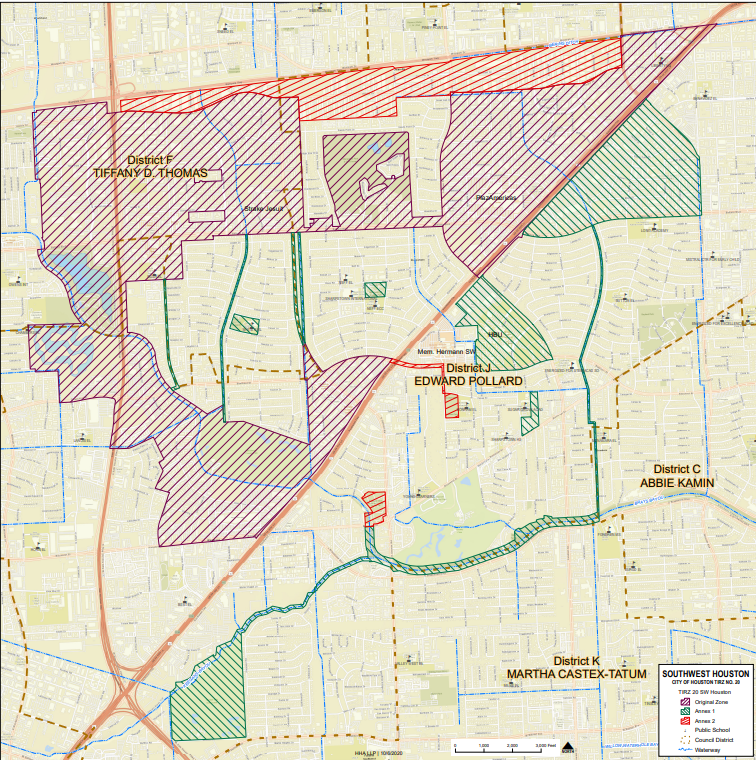

Look at the map of TIRZ #20 below. The colored areas crossed by diagonal lines are part of the TIRZ.*

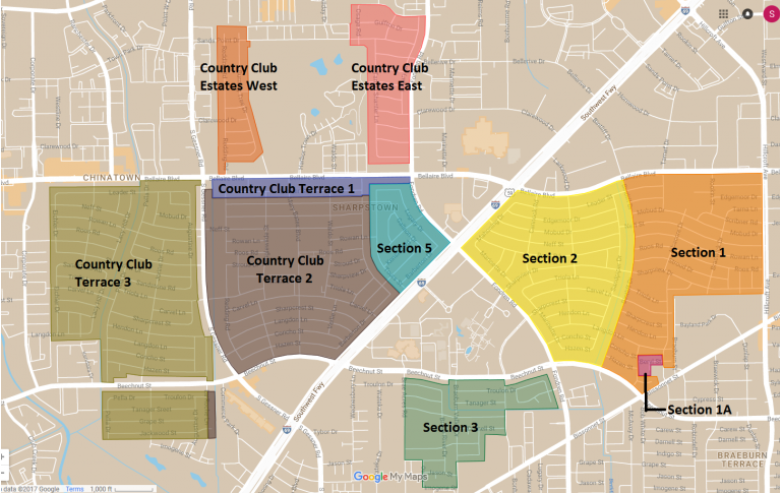

Now, look at the map (below) of all the homes that are part of the Sharpstown Civic Association (most of the houses in Sharpstown). Notice how it almost fits perfectly, like a puzzle piece, into the gap in the middle of the TIRZ?

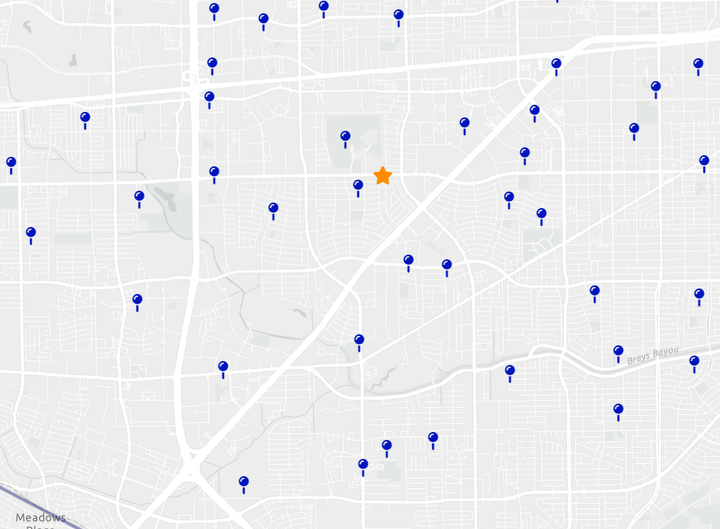

In other words, if you live in a house and pay dues to the Sharpstown Civic Association, you probably aren’t part of the TIRZ (and thus probably don't pay taxes to it). If you live in an apartment on Beechnut between Gessner and Brays Bayou, you probably aren’t part of the TIRZ either. But the TIRZ does include places like Houston Christian University, Chinatown, the PlazAmericas Mall, and many apartments north of the mall.

Technically, almost everyone in the community funds TIRZ #20 indirectly. If you eat at a restaurant in Chinatown or shop at the La Michoacana on Gessner, some of your money goes toward their property taxes, which go toward TIRZ #20’s projects.

If you live in the community and have questions, concerns, or ideas about what projects TIRZ #20 should work on next, you can make a public comment at their board meetings, which usually happen on the second Thursday of every second month at 12 PM. (However, their website says you should verify that at 832-638-2545, just in case the dates change.) The meetings are held at the Southwest District Office, Suite 168 at 6588 Corporate Drive. You can read about the latest meeting here.

By the way, the Brays Bayou Trail on the back side of Club Creek Park is under construction, but the park is still beautiful—and open to the public.

You should check it out.

*Technically, the map is slightly outdated. The borders of the TIRZ expanded slightly in 2023.

Photos of Club Creek Park. The sloping concrete pad in the distance behind the fountain is the spillway for water to travel from Brays Bayou into the detention pond.

Comments ()